Temporary Assistance for Needy Families (TANF) is a federal block grant that helps reduce childhood poverty and promote family safety, stability, and self-sufficiency. Each year, Colorado receives roughly $136 million in TANF funds which it uses for direct cash assistance and other family services. In 2023, TANF helped provide cash assistance payments to 47,003 Colorado children living in extreme poverty.

Federal TANF Requirements

TANF is one of the most flexible federal funding streams. States have broad spending discretion so long as dollars are used to support one of four stated purposes:

- “Provide assistance to needy families so that children can be cared for in their own homes or in the homes of relatives

- End the dependence of needy parents on government benefits by promoting job

preparation, work, and marriage - Prevent and reduce the incidence of out-of-wedlock pregnancies

- Encourage the formation and maintenance of two-parent families.”

However, there are a few federal restrictions on spending.

Income Eligibility

Funds can only be used to support pregnant women and families with children who are financially needy. States define who meet this criterion. In Colorado, families are eligible for TANF if they make less than $75,000 a year, with the exception of the basic cash assistance program, which only serves families living in extreme poverty.

Work Requirements

States must meet work participation rate (WPR) requirements, which specify the percentage of families that must be engaged in a work activity while enrolled in a TANF program. Federal law establishes general work activity categories like going to school or job hunting, but states can choose which specific activities they will allow. Examples of eligible work activities in Colorado include subsidized employment, job training, and active job searching.

Time Limit

Families can receive TANF benefits for a total of 60 months. However, states can provide extensions for up to 20% of recipients.

State Contribution

States must commit state funding to receive federal TANF dollars. Each state must spend a dollar amount equal to the percentage of what the state spent on social services prior to the creation of TANF in 1996. This is referred to as the state’s maintenance of effort spending (MOE). In federal Fiscal Year 2022-23, Colorado’s largest MOE spending was on pre-Kindergarten/Head Start and refundable tax credits.

TANF Supports Child Care and Child Welfare

A state can transfer up to 30% of TANF funds to the Child Care Development Fund (CCDF) to support child care subsidies and the Social Services Block Grant (SSBG) to support child welfare services.

TANF in Colorado: Colorado Works

Colorado is one of 10 states that operate a state-supervised, county-administered TANF program. Colorado counties receive a majority of the state’s TANF dollars and have broad spending discretion to meet their local needs. In a study of four county-administered TANF programs, Colorado’s program was found to provide the most county autonomy and least state oversight.

Colorado’s TANF program is known as Colorado Works. Colorado Works helps families move toward self-sufficiency by providing basic cash assistance and other services including individualized case management, education, training, and support to meet career goals.

Basic cash assistance is the largest component of the program. Colorado Works provides modest monthly payments to eligible families for basic needs like food, diapers, clothing, and bus passes. In 2024, families received basic cash assistance for an average duration of five to eight months, depending on the type of household.

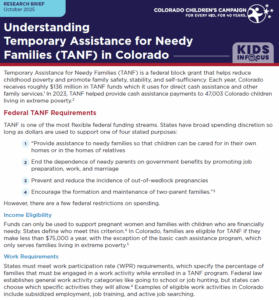

The amount of benefits a family receives is based on their household size. For example, an eligible single parent with two children can receive up to $620 per month, or roughly $20 a day. Until recently, the benefit value had not been adjusted to keep up with inflation. In 2022, Colorado made a 10% increase to benefits and added an annual cost of living adjustment (COLA) to prevent further erosion to the value of payments.

Colorado Works Eligibility Requirements

Families must meet state-determined eligibility requirements to participate in Colorado Works and re-certify their eligibility every six months.

Income Eligibility for Career & Support Services

Families qualify for Colorado Works services, excluding basic cash assistance, if their annual income is $75,000 or less. Families must also be pregnant or caring for a child, a U.S. citizen or lawful permanent resident, and living in Colorado.

Income Eligibility for Basic Cash Assistance

In addition to the requirements above, families must be living in deep poverty to receive basic cash assistance. Colorado law establishes the maximum income a family can earn and still be eligible, known as the need standard. This standard varies by household size. For example, a single parent with two children must earn no more than $421 a month, or roughly $5,000 a year. Eligibility for basic cash assistance has not been changed in Colorado in decades.

Monthly Income Eligibility for Basic Cash Assistance

In 2022, Colorado enacted a new rule to disregard new sources of family income for the first certification period that the income impacts, allowing families to continue receiving basic cash assistance for a short period of time after securing higher-paying employment.

Work Requirements

Work-eligible families must comply with an individualized work plan developed with their case manager. Colorado’s program accepts a variety of work activities, including traditional employment, going to school, and applying for jobs. However, there are exemptions from work requirements for families that demonstrate good cause, such as single parents who have an infant at home.

Time Limit

A family can receive benefits for total of 60 months. However, Colorado grants extensions to up to 20% of families who demonstrate good cause, such as single parents who have an infant at home.

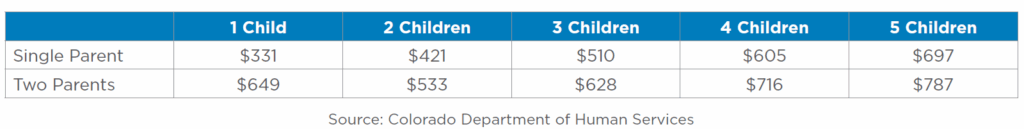

TANF Spending in Colorado

Colorado spent a total of $161.4 million from the TANF block grant and reserves in state Fiscal Year 2023-24. Basic cash assistance was the largest expenditure ($87 million), followed by administrative costs ($46 million), supportive service payments ($21 million), and third-party contracts ($6 million). Currently, there are not state-level data available to further specify how these funds were spent or to track outcomes associated with that spending.

TANF Spending in Colorado, FY 2023-24

State and County Reserves

Colorado maintains a portion of TANF funds in state and county reserves to help respond to evolving needs across years. Colorado is the only state that has separate county-level TANF reserves. According to Colorado law, the state reserve must maintain a minimum balance of $33.9 million, 25% of the state’s annual TANF block grant. Counties can also maintain reserves of up to 40% of their annual TANF allocation or $100,000, whichever is greater. In state Fiscal Year 2024-25, the beginning balance in the state reserve was roughly $87.5 million and the beginning balance of all county TANF reserves was $35.6 million.

Allocations to Counties

The Colorado Works Allocation Committee (WAC), a group of county and state representatives, determines each county’s annual allocation of TANF funds based on an established formula which accounts for demographics and prior year expenditures. The WAC reviews the allocation formula annually and monitors TANF spending. In state Fiscal Year 2023-24, larger metropolitan counties such as Denver, Adams, Arapahoe, and El Paso received the largest percentage of funds, while smaller rural counties like Cheyenne, Hinsdale, and Mineral received the smallest percentage of funds.

Recent TANF Improvements in Colorado

In recent years, Colorado has made a number of policy changes to better support families through TANF spending.

The following policy changes were made by HB22-1259:

- The amount of basic cash assistance was increased by 10% after years without adjustments for inflation other than an increase in 2018.

- An annual cost of living adjustment (COLA) was added to basic cash assistance to prevent further erosion of payment value in the future.

- Eligibility calculations were updated to disregard new sources of family income for the first certification period that the income impacts after a family has secured higher-paying employment.

- Exemptions from work requirements under certain circumstances were established, including for single-parent households with an infant.

- Eligibility criteria were updated to permit people with drug felonies to participate in the program without additional requirements.

- Extensions for the 60-month lifetime limit under certain circumstances were established, including for single-parent households with an infant.

In addition, Colorado has made changes to sanction and re-engagement policies and processes. Families enrolled in TANF face penalties when they are out of compliance with requirements in the program. These penalties include sanctions that withhold all or a portion of basic cash assistance. Due to the lack of evidence to support the effectiveness of sanctions, Colorado made changes to reduce the use of punitive sanctions and to instead increase efforts to reengage families in the program in other ways.

Finally, in 2017, Colorado was the first state to provide the full amount of child support payments directly to families enrolled in TANF and disregard these payments in calculating benefit amounts. Prior to this policy change, families were required to relinquish their rights to these payments in exchange for receiving TANF benefits. Later, in 2020, Colorado passed a law requiring counties be reimbursed at least 90% of their share of child support collections by the state in order for child support payments to continue to be passed through to families.

Learn more about TANF in Colorado:

- Research brief: “Essential, Research-Based Strategies to Modernize TANF in Colorado”

- Blog post: “How Can We Make Sure Colorado’s Efforts to Support Kids Experiencing Extreme Poverty Are Working?”

Sources

1 Colorado Joint Budget Committee. (2024). Staff Budget Briefing FY2025-26 Department of Human Services.

2 Colorado Department of Human Services. (2023). Administrative data request.

3 U.S. Department of Health & Human Services, Administration for Children & Families. (2024). About TANF.

4 Center on Budget and Policy Priorities. (2022). Policy Basics: Temporary Assistance for Needy Families.

5 Colorado Department of Human Services. (n.d.). Colorado Works.

6 U.S. Department of Health & Human Services, Administration for Children & Families. (2024). TANF and MOE Spending and Transfers by Activity, FY 2023: Colorado.

7 Center on Budget and Policy Priorities. (2024). To Strengthen Economic Security and Advance Equity, States Should Invest More TANF Dollars in Basic Assistance.

8 U.S. Department of Health & Human Services, Administration for Children & Families, Office of Planning, Research & Evaluation. (2015). A Descriptive Study of County-Versus State-Administered Temporary Assistance for Needy Families Programs.

9 Colorado Department of Human Services. (2024). Colorado Works (TANF) Annual Report (SFY24).

10 9 CO Code Regs 2503-6. CO Works Rules.

11 Colorado General Assembly. (2024). HB22-1259 Modifications to Colorado Works Program.

12 Code of Federal Regulations. (1999). 45 CFR Part 261—Ensuring That Recipients Work.

13 Colorado Department of Human Services. (n.d.). Colorado Works Allocation Committee.

14 Colorado Department of Human Services. (2024). Works Allocation Committee Meeting.

15 9 CO Code Regs 2503-6, Section 3.608.3. Re-engagement and Good Cause.

16 C.R.S. 26-13-108. Recovery of public assistance paid for child support and maintenance — interest collected on support obligations – designation in annual general appropriations act.

17 C.R.S. 26-2-108. Granting of assistance payments and social services — rules.

Loading...

Loading...