» Priorities » Economic SecurityEconomic Security

We speak up for economic security so that families with children have the financial resources and housing to support their economic security.

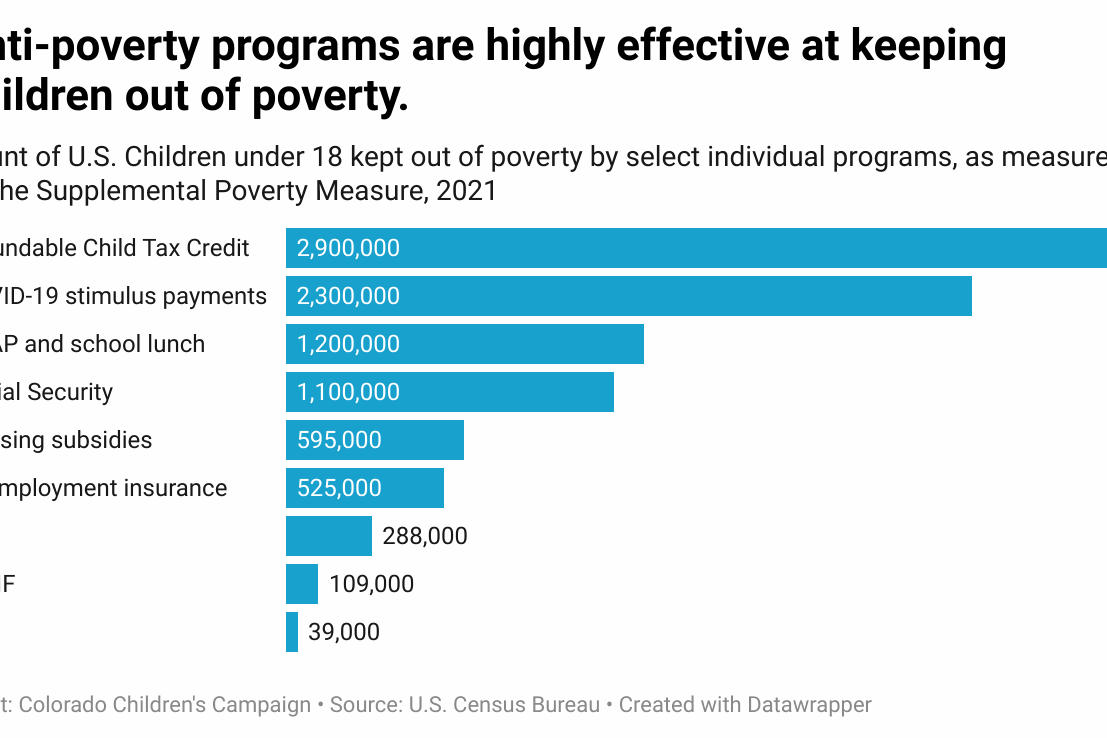

When kids’ basic needs are met, they can thrive today and in the future. The Colorado Children’s Campaign has helped bring focused attention to the policies that affect the children in our state whose families have the least resources. The Campaign draws attention to what works and what doesn’t work when it comes to promoting economic security – and makes sure the thousands of Colorado children who are living in extreme poverty are not forgotten by state lawmakers.

Support for children living in extreme poverty: The Campaign has focused on modernizing programs that help children with the fewest resources meet their basic needs, including making sure families that receive basic cash assistance through Colorado Works receive ongoing cost-of-living adjustments.

Making housing work for families and children: As housing in Colorado has grown increasingly unaffordable, The Campaign is making sure policymakers and communities understands how the housing crisis is affecting families – and what we can do to help.

Tax credits that make a difference: The Campaign advocates for a tax system that works for kids, including the Child Tax Credit and the Family Affordability Tax Credit

OUR PRIORITIES

- Supporting kids living in extreme poverty

- Moving kids out of poverty

- Eviction and homelessness prevention

- Family supports

- Fiscal reform

- Federal advocacy

- Data improvements

THE CAMPAIGN’S 2026 BILL TRACKER IS HERE!

Recent legislative highlights

Temporary Assistance for Needy Families (TANF) (HB25-1279 & Budget Win!)

Families with very low incomes who receive basic cash assistance through TANF will see a cost-of-living increase beginning in 2026. Legislators also passed a bill that will improve data collection for this program, ensuring any future changes are grounded in real-world impact and accountability.

Family Affordability Tax Credit (HB25-1335 & Budget Win!)

The Family Affordability Tax Credit is a refundable, means-tested tax credit providing up to $3,200 per child under 6 and $2,400 per child aged 6 to 16 for eligible families. Legislation protected this vital credit, which is projected to make Colorado’s child poverty rate the lowest in the country and 40% lower than the second-lowest state.